With experience in water treatment, a wide separation equipment portfolio and a specific know-how on wellhead processes Unidro is a highly qualified partner for PWT.

The Produced Water problem

Making produced water suitable for reinjection or disposal means to identify and design the necessary separation and conditioning steps taking into account the very peculiar characteristics of each individual site.

Inlet water temperature, salinity, chemical stability, oil dispersion as well as outlet parameters: conditions are different for each individual project and every treatment is a case history itself.

One stop shop principle

Unidro combines the expertise to deal with the PWT problem, the know-how to design a “tailor made” system, a complete portfolio of our own separation equipment.

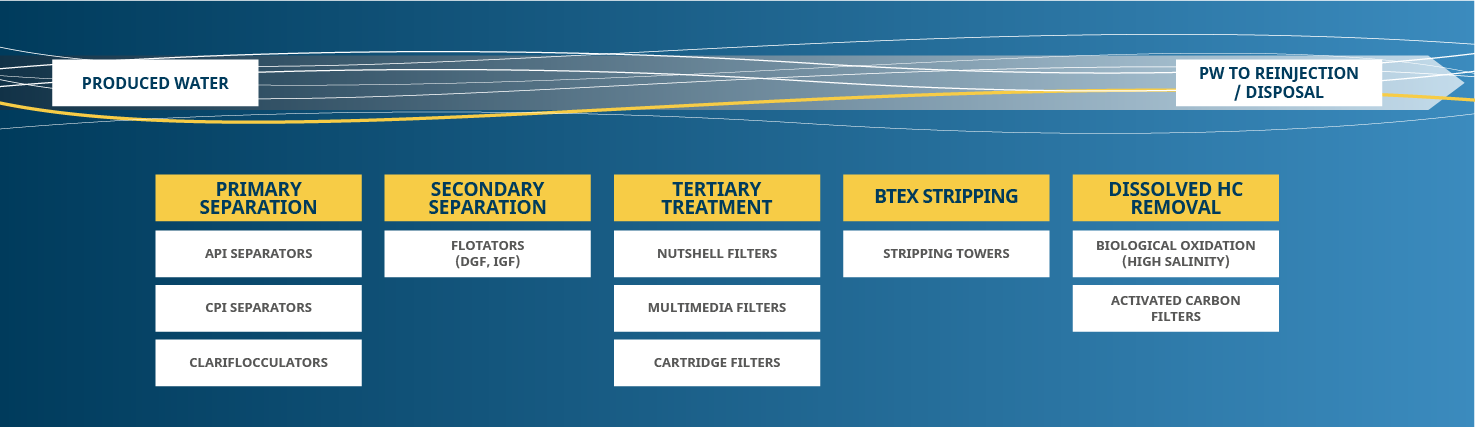

- Primary Separation for desanding and coarse oil removal

- Secondary Separation for fine oil removal

- Tertiary Separation for suspended solids and oil polishing by media filtration

- Special Treatment BTEx strippers, biological treatment

- Final Guard Filtration

- Injection manifolds

FEED, process consultancy, after sale site services

The experience of Unidro in treating produced water in very challenging conditions in North Africa, Middle East and South Pacific Region gives us the know how to support our clients when the feasibility of a PWT is to be investigated and all the required parameters need to be identified and measured. Portable equipment for analysis and jar tests, pilot units for testing can be available during feasibility study provided by Unidro.

In case of existing facilities, process and know-how support for optimisation, revamping, debottlenecking or retrofitting existing equipment can be provided by Unidro teams to clients worldwide.