Established in 1971, Unidro is a global player in water, wastewater and utilities related process technology for the industrial markets.

Our reputation on the international market is confirmed by the repeated orders from top clients who appreciate the main values of our company:

DEPENDABILITY, FLEXIBILITY, FULL COMMITMENT TO CLIENT SATISFACTION

A vertical integrated company for 100% tailor made solutions

With an unrivalled flexibility in matching with client’s requirements, project specifications, design standards, local regulations, every plant realized by Unidro represents the best solution to meet EPC contractors and End Users needs.

From the selection of the most suitable technology to the optimized process design, from the accurate basic and detail engineering to the fabrication in our shops of every piece of equipment, all our projects are completely developed in-house and are 100% custom tailored products, really tailor made from the conceptual design to any minor engineering detail.

In house know how

The extensive in house know how, built on the experience of the company and shared by each of our engineers and managers, makes every project the result of a real teamwork dedicated to every customer.

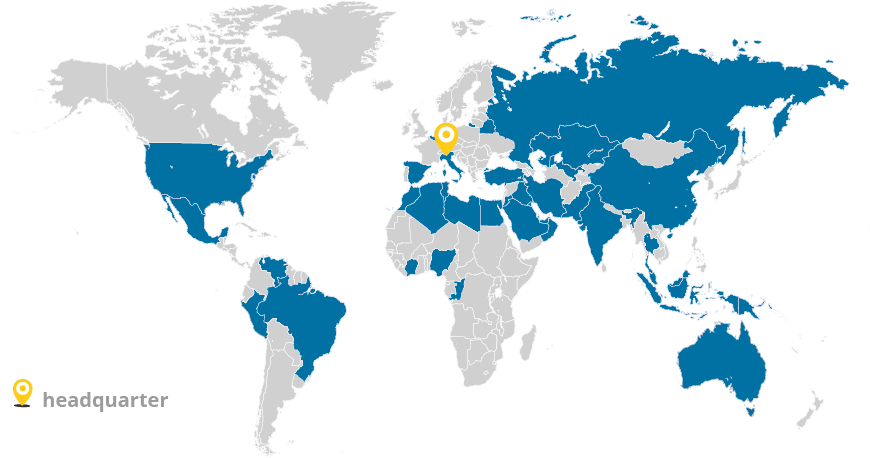

Our portfolio, a blend of conventional and proprietary technologies, combined with the wide range of services and professional skills we offer to our clients make Unidro a qualified technology partner for the most demanding EPC contractors and End Users worldwide.

Site services to operators

We offer a wide range of water and process management services designed to support plant personnel and end user organizations to get the most out of their systems.

• A team of service engineers ready to assist our customers in trouble shooting at their premises

• A team of process specialists dedicated to commissioning, start-ups, chemical tests, surveys, training

Some of the major Oil Companies have repeatedly asked our professional training sessions to operators and maintenance teams.

Committed to After Sales support

Our after sales team is always ready to supply spare parts and consumables.

Our team is available 365 days for immediate processing of any urgent request for consumables and spare parts. With the flexibility of a call-off agreement, our clients may have access to stocks available in some strategic locations for prompt supply of filter elements and other critical items.