Constantly at the cutting edge of developments

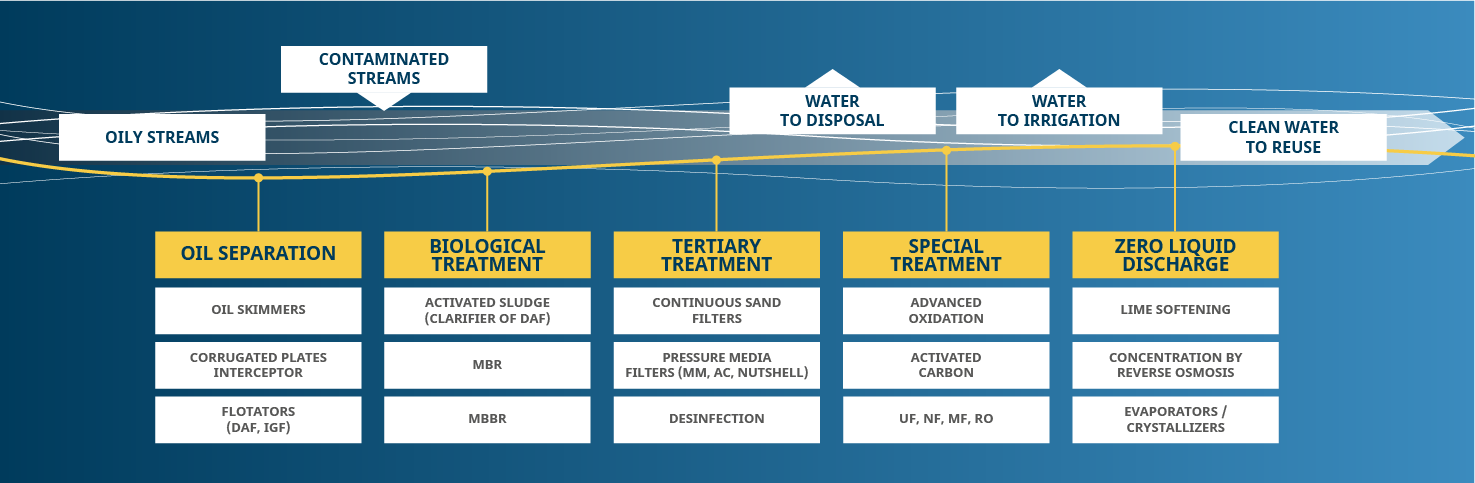

With a wide experience in the treatment of industrial wastewater and the knowledge to treat difficult process streams, we can match the most demanding regulations worldwide and handle the critical problem of water reuse.

In our projects, we apply all the “traditional” technologies for primary wastewater treatment such as desanders, API separators, clariflocculation and sedimentation, air flotation.

After biological oxidation, our specific tertiary treatments meet strict environmental parameters with final trimming of BOD, COD and SS.

And when wastewater is to be reused, with our experience in membrane technology, brine treatment and evaporation systems we can identify the most competitive solution to minimize feed water consumption and reduce waste delivery, including ZLD.

Overall process system design: our experience ranges from chemical plants to oil refineries.

In house detail design of each treatment step.

Fabrication of the main equipment in our own shops.

System automation, software design, operation monitoring by our specialists.

Special Treatments

Specific contaminant removal to meet very strict parameters, such as fluoride removal from microchips industry waste to the ppm’s level, phenols removal from chemical waste, H2S oxidation to ppb’s level, BTEx removal from refining process or from produced water.

Spent Caustic streams treatment with controlled dosage in high salinity biological steps or with thermal evaporators (ZLD).