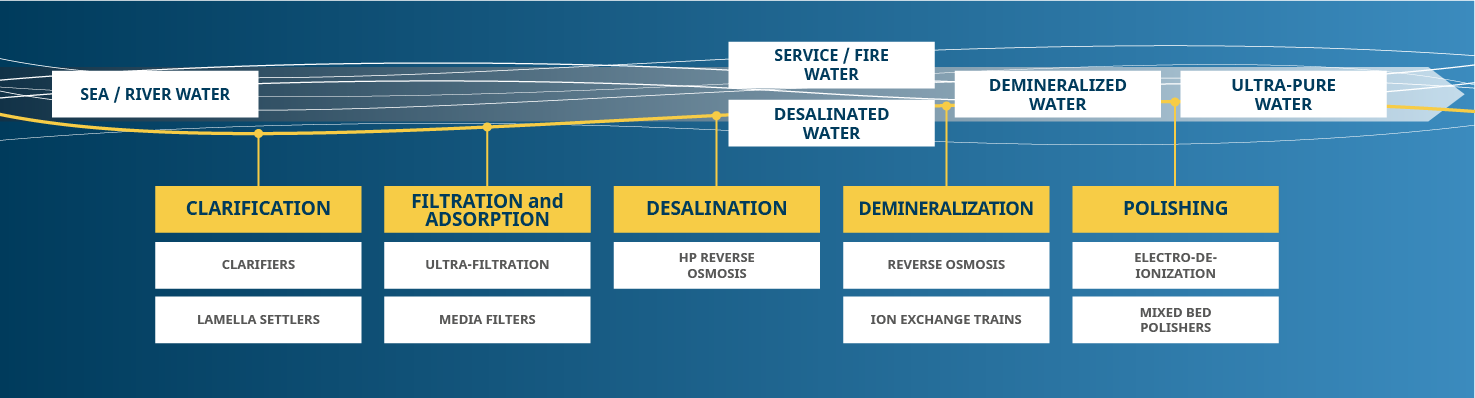

With the company experience of four decades in the water treatment and the high specialization of our engineering staff, Unidro can propose for every project an optimized combination of process steps to make the water available at site suitable as Cooling Water, boiler feed water and process water in the industries.

Unidro has a comprehensive demonstrated track record of treating any kind of feed water (from sea, river or well) and of dealing with the most challenging environmental conditions such as world hottest countries, desert, very cold areas.

We take water from sea, river or well and treat it to your process grade quality.

With complete range of technologies and know-how in the water treatment for the Oil&Gas, Chemical and Power Industry, Unidro combines the experience of System Integrator and Service Provider with the advantages of a Product Manufacturer. Review our portfolio and send us your requirements for an optimized process solution.

Tailor Made Solutions

With our unrivalled flexibility in matching any client’s need, specification, design standard, local regulations, every plant realized by Unidro represents the best solution to meet our customer needs.

From the selection of the most suitable technology to the optimized process design, from the accurate detail engineering to the fabrication in our shops of every piece of equipment, all our projects are completely developed in-house and are really tailor made from the conceptual design to any minor engineering detail.