Understanding the differences between SEIS and EIS

Whether you are starting a new venture or looking to expand an existing business, finding the necessary capital can be a daunting task. Luckily, government funding initiatives can provide a valuable boost to your business growth.

In this blog, we will delve into the world of government funding in the form of the SEIS and EIS schemes. We’ll provide insights into how you can navigate this landscape to access the financial resources you need by looking at how other businesses have achieved the same.

So, if you’re ready to unlock the possibilities of SEIS and EIS and take your business to new heights, let’s dive in!

What is SEIS?

SEIS is a tax scheme introduced by the government to encourage investment in early-stage startups and small businesses to fuel innovation.

To be eligible for SEIS, certain criteria need to be met. Firstly, your business must be a UK-based company and have a permanent establishment here. It should also be no more than two years old from the date of its incorporation.

Some of the features that make SEIS an irresistible option for small business owners and solopreneurs are as follows:

- 50% Income tax relief

- Capital Gains Tax exemption

- Losses relief

- Investor confidence

- Capital gains reinvestment relief

Want to find out more about the SEIS tax relief? Don’t fret, we got just the article for you.

CTA: Get SEIS assurance with Sleek’s expert support – save time and money.

What is EIS?

EIS is another government-backed initiative aimed at encouraging investment in early-stage companies and fostering innovation.

To be eligible for EIS, certain criteria need to be met. Firstly, your business must be a UK-based company with a permanent establishment here. It should also have gross assets not exceeding £15 million before the investment and £16 million immediately after the investment.

Here are some of the features that make EIS an enticing option:

- Income tax relief

- Capital Gains Tax exemption

- Losses relief

- Investor confidence

- Seed Enterprise Investment Scheme (SEIS) compatibility

The SEIS and EIS schemes are suitable for and applicable only to certain industries. In 2019-2020, Information and Communication received the most SEIS investments (37% or £62 million).

Manufacturing, Wholesale and Retail Trade, and Professional, Scientific, and Technical sectors combined for 34% of overall investment.

Other eligible sectors include Consumer Products, E-Commerce, Education, Environment, Fashion, Fintech, Food, Games, Health, High Technology, Leisure, Marketing, Media, Other, Retail, and Social.

Interested in EIS benefits and want to know more? Check out our article, “How small businesses can take advantage of the SEIS and EIS schemes“.

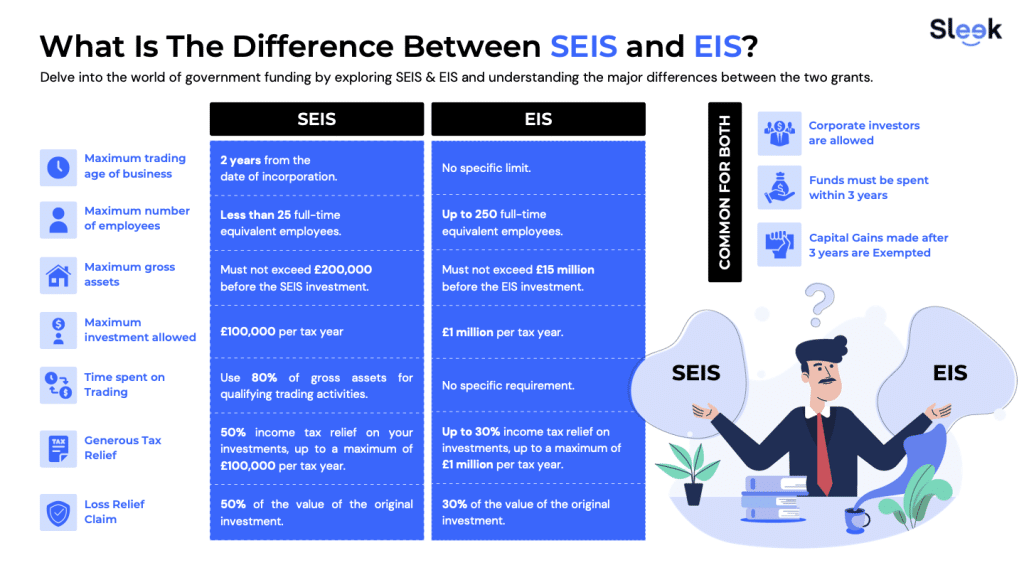

Eligibility differences between SEIS and EIS

Before you make any decision as to which scheme to apply for, it is important to understand the difference between SEIS and EIS.

Secure tax benefits today. Let Sleek handle your Advance Assurance application – expert assistance, no stress.

Which scheme is best for your business?

SEIS serves as a launchpad for early-stage startups, seeking crucial seed funding to fuel initial growth and establish a strong foundation.

On the other hand, EIS provides opportunities for established businesses aiming to scale up and expand their operations.

When deciding between SEIS and EIS, consider the following factors:

- Assess the current stage of your business.

- Define your investment objectives clearly.

- Evaluate the eligibility criteria and compliance requirements for both the SEIS and EIS schemes.

- Understand how investors perceive each scheme.

How do I apply for or claim SEIS and EIS?

To ensure you make your SEIS or EIS claim a success, it’s highly recommended you seek professional guidance and support.

Engaging a professional service can provide the expertise and assistance needed to navigate complex processes and increase your chances of successfully raising funds through these investment schemes.

Is the EIS at risk to the capital condition? Curious to find out? Click on that link to our article!

Gain assistance with your SEIS or EIS scheme. Save time, money, and effort with Sleek’s support.

Conclusion

Understanding the differences between the Seed Enterprise Investment Scheme (SEIS) and the Enterprise Investment Scheme (EIS) is crucial for small business owners and solopreneurs seeking investment opportunities.

SEIS offers higher tax relief percentages, with a focus on early-stage startups, while EIS provides greater investment limits and accommodates more established businesses. To make the right choice, it’s essential to assess your business stage, investment objectives, and eligibility criteria for each scheme.

Seeking professional advice and guidance from a tax professional or advisor is highly recommended. Our advisors at Sleek provide personalized insights and help you explore and leverage the appropriate scheme based on your circumstances, increasing your chances of securing investment and fueling your business growth.

Get investor-ready with Sleek – it’s fast and simple. SEIS Advance Assurance is a government-backed statement that shows investors that investing in your business will allow them tax relief. Sleek helps get your company set up for investment, so you can start growing your business.

FAQs

SEIS and EIS provide tax relief incentives to encourage investment in eligible companies. SEIS offers a generous 50% income tax relief on investments up to £100,000 per tax year, while EIS provides up to 30% income tax relief on investments up to £1 million per tax year. Both schemes offer Capital Gains Tax (CGT) exemptions on gains made from selling shares after three years.

Yes, it is possible to switch from the Seed Enterprise Investment Scheme (SEIS) to the Enterprise Investment Scheme (EIS) or vice versa under circumstances like time restrictions, eligibility criteria, compliance requirements, and investor consideration.

No, non-UK residents or companies are generally not eligible to take advantage of the Seed Enterprise Investment Scheme (SEIS) or the Enterprise Investment Scheme (EIS).

Yes, there are differences in the investment limits and requirements for the Seed Enterprise Investment Scheme (SEIS) and the Enterprise Investment Scheme (EIS).

While the maximum amount an individual investor can invest in SEIS-eligible companies is £100,000 per tax year, the maximum amount an individual investor can invest in EIS-eligible companies is £1 million per tax year.

This depends on:

- How old the company is

- The limit of gross assets

- Employee count

- The use of funds for specific business purposes.