Sole trader vs limited company in the UK: which one should you choose?

Should I set up as a sole trader or a limited company? That is the first question that pops up when you decide to start your own business. Is it a clear-cut choice? No. There is a lot to consider: compliances, tax benefits, access to grants, hiring implications, and more. An in-depth understanding of both these types of business structures is required. Also, it all depends on your business and your specific circumstances.

This article will guide you through the two routes: sole trader vs limited company, so that you can decide which one would work best for you.

Sole trader vs limited company: more than a legal framework

First and foremost, be aware of the legal implications of both business structures.

- As a sole trader, you and your business are one legal entity. In the eyes of the law, you work for yourself and are personally responsible for your business’s debts or financial losses.

- As a limited company, you and your business are not one but two legal entities. As a director, you get legal protection. You are liable only for the money you have invested in your business.

It may surprise you, but the business structure you choose — sole trader or limited company — could save you from a cash crunch in the early days. The UK government gives startups finance and support for their business, but it’s different strokes for different folks.

So let’s closely examine the other differences between a sole trader vs a limited company.

Need help managing your accounting or filing your Self Assessment tax return? Our experts are here to help you.

Sole trader: the advantages of going alone

If you decide to start your business as a sole trader, you will not be alone. At the start of 2022, the UK private sector business population comprised 3.1 million sole proprietorships (56% of the total), 2.1 million actively trading companies (37%), and 353,000 ordinary partnerships (6%).

Let’s see why sole trading is still the most popular way of doing business in the UK.

- Simple and inexpensive to set up and run: As a sole trader, you can immediately hit the ground running. There is no requirement to register with Companies House. All you need to do is inform HMRC that you pay taxes through Self Assessment and continue to file a tax return every year.

- More flexibility in decision-making: As there are no shareholders or partners to consult, you are in complete control over your business decisions.

- More privacy of information: Your financial information does not get into the public domain, as you do not have to register with Companies House.

- Minimal statutory compliances: Your record-keeping requirements are minimal, but you do need to follow certain government rules on running a business, be it telling HMRC about filing your returns or keeping records of all your expenses.

Not sure how to upload documents to companies house? Check out our article, “An introduction to Companies House for solopreneurs“.

Sole trader: losing out on company benefits

While simpler and easier to operate, there are disadvantages too of being a sole trader:

- Unlimited liability for business debts. All the risks associated with running the company are yours. So if your company is ever sued, your house or car can be seized to pay off the debts.

- Limited ability to raise capital. To seek investment, sole traders need to convert to partnerships, a complex process in itself. Even so, lenders and investors prefer limited companies, so being a sole trader could hamper the growth of your company.

- Limited access to large contracts. As a matter of policy, many large organisations enter into contracts with incorporated businesses only.

- Less tax-efficient. All profits of sole traders are taxed, regardless of withdrawals from their business bank account. Personal income tax rates are also higher than corporation tax, and can go up to 45%.

Curious about the small business tax rate? Click on that link to our article!

Need help managing your accounting or filing your Self Assessment tax return? Our experts are here to help you.

Limited company: fewer risks, multiple benefits

Incorporation doesn’t just provide a safety net if a business fails. It opens avenues for business growth.

- Limited liability. As shareholders, your personal financial risk is greatly reduced. If you are in an industry like construction, where the risk of being sued for damages is high, incorporating your company might be a wise move. Want to find out more about limited liability partnerships. If so, click that link to our article!

- Potential to attract investors. A registered company is seen as a more stable business and therefore of lower risk. This makes it more attractive to investors.

- Ability to raise capital. As a limited company, you can also easily sell shares in your business to an investor.

- More tax-efficient. Limited companies pay corporation tax, which is lower than personal income tax, and also qualify for a wider range of allowances. In addition, dividends aren’t subject to National Insurance and have a lower income tax rate than a salary.

Limited company: more paperwork, higher cost

Red tape is the key disadvantage of a limited company:

- More complex and costly to set up and run. For example, even if there is no employee other than yourself, you will also have to register the company as an employer and set up payroll.

- More reporting requirements. Multiple reporting in real-time takes a lot of time to prepare and paperwork to file. For example, whenever you make staff payments, you have to report to HMRC.

- Less privacy of financial information. When you file your company’s accounts, these documents will be in the public domain and can be seen on sites such as Companies House.

- Directors have legal responsibilities. As a company director, you will have a host of legal responsibilities that go way beyond paying corporation taxes. For instance, you are legally bound to tell other shareholders if you might personally benefit from a transaction the company makes. And there can be consequences.

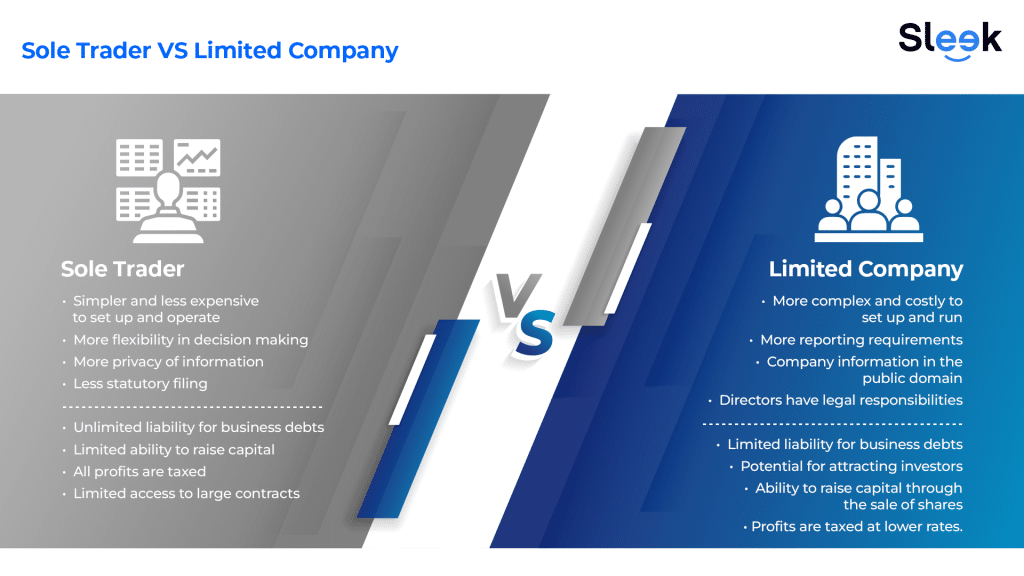

At a glance: sole trader vs limited company

So should I set up as a sole trader or a limited company?

If reducing personal risk is a priority, then a limited company is the right option. But be prepared for the responsibilities, and the added paperwork, that go with limited companies. If you want to keep your business operations simple, then choose to become a sole trader.

Sole trader vs limited company: tax efficiency

The bottom line — your post-tax earning — is a key determinant. It’s important that you examine the tax implications from all angles.

As a sole trader, your entire profits are taxed at income tax rates and can go up to 45%. But as a limited company, you pay tax only on your salary as an employee and not the entire profit. Of course, the company has to pay corporation tax on the net profit, which is much lower at 25% (smaller companies whose profits do not exceed £50,000 will pay 19% from 1 April 2023).

On the other hand, when selling their business assets, sole traders enjoy tax relief via capital gains tax on profits. Limited companies, instead, have to pay Corporation Tax on profits from selling their assets.

And it’s not only about the bottom line. Your peace of mind matters. Tracking these ever-changing tax laws can be taxing.

Need help managing your accounting or filing your Self Assessment tax return? Our experts are here to help you.

Sole trader vs limited company: other considerations

The tipping point in your decision between setting up as a sole trader or a limited company could be as simple as:

- The desire to protect your company name. Only limited companies can register their names,

- The desire to sell your business after a few years. Transferring ownership is much easier in a limited company, OR

- The desire to start a side hustle alongside your 9-5 job. Sole trader becomes an obvious choice as it is easy to set up and close.

Sole trader vs limited company: The way forward

As a thumb rule, becoming a sole trader is recommended if you’re starting your venture and plan to work alone. But if you envisage a larger-scale operation with more employees, then incorporating a limited company is the way to go.

We recommend that you hire someone take care of all your paperwork, so that you are free to pursue your business success.

If you’re unsure about any aspect of your taxes or need assistance with financial tax planning, consulting tax advisors at Sleek will save you time, money, and potential headaches. At Sleek, we provide accounting services to aid you with an efficient and seamless tax process.

We at Sleek can help you save time and money with our easy and efficient tax advisor services. Do get in touch if you need a hand!

FAQs

Yes, there is nothing to stop you from switching, if operating as a limited company will serve you better. Sleek can advise you through the process.

It would be prudent to switch when:

- You are paying higher taxes on your increased earnings.

- You require business funding.

- You need to enhance your image to attract customers.

- You want to bring new talent on board.

Yes, you can take on additional employees, provided you go through the employer registration process with HMRC.

The company could pay you a salary and/or dividends on your shares. However, your dividend is taxable after taking into account your personal allowance and dividend allowance as a director of a limited company.

Although hiring one isn’t mandatory, it’s a good idea to use the services of an accountant to keep your tax affairs absolutely in order.

Once you form your own limited company, your company’s money is no longer your own. Company earnings will therefore not be part of your personal tax return.