EIS Changes – Knowledge Intensive Companies

HMRC announced a number of changes to EIS, SEIS and other Venture Capital Trust (VCT) schemes which include preferential terms for companies that meet the conditions for a knowledge-intensive company.

For knowledge intensive companies, the following changes have been made:

- The number of full time equivalent employees must now be less than 500 instead of 250.

- The total investment limit across all schemes has increased from £12 million to £20 million.

- The basic age limit by which the initial relevant investment must be made is now 10 years after the company’s first commercial sale instead of 7 years.

What Is A Knowledge Intensive Company?

To be a knowledge-intensive company, at the time of the investment the company must meet:

- At least one of the two operating costs conditions and

- Either the innovation condition or the skilled employees condition.

Curious about the pitfalls to avoid in SEIS and EIS? If so, check out our article “SEIS & EIS – 10 Common Pitfalls To Avoid“.

The operating costs conditions:

The first operating costs condition: the company must have spent at least 15% of its relevant operating costs on research and development or innovation in one of the three relevant years preceding the date of the investment.

The second operating costs condition: the company must have spent at least 10% of its relevant operating costs on research and development or innovation in each of the three relevant years preceding the date of the investment.

If the company is a parent company of a group of companies, the relevant operating costs to be considered include the costs of any subsidiary of the company at the time of the investment.

A company’s operating costs are all those that are in the profit and loss account or income statement, including cost of sales.

To achieve a fair view of the company’s operating costs:

- Capitalised revenue expenditure is included in operating costs

- Depreciation and amortisation must be excluded

- Exceptional items must be excluded.

Where the company meets the innovation condition, the research and development or innovation costs are costs that are directly attributable to the work carried out to create the relevant intellectual property. Where the company does not meet the innovation condition but does meet the skilled employees condition, the costs are those that are for the work carried out by the skilled employees.

Wondering about EIS rules? If so, check out our article “EIS Investment Time Limit – The 7 Year Rule”.

The innovation condition:

In order to meet the innovation condition, a company will be engaged in carrying out work to create intellectual property at the time of the investment and it will be reasonable to assume that within 10 years of the investment most of the company’s business activities will consist of:

- The exploitation of that intellectual property or

- Business which uses the intellectual property

- Or both.

Companies can work with others to create the intellectual property. However, the greater part by value of the intellectual property must be created by the company and the company must retain the right to exploit the intellectual property it creates.

If a company is a parent of a group, the innovation condition applies to the group as the whole and the group’s business activities must largely depend upon the exploitation or use of the intellectual property.

Evidence is required for meeting the innovation condition. The company may already have created intellectual property or be carrying out work to create intellectual property. If this is the case they will already have documentary evidence to show that it is developing an idea, for example, business cases, progress reports and applications for trademarking or patents. If the intellectual property has already been created at the time of the investment, it must have been created within the preceding three years.

The company may be in the early stages of development and may not have the evidence to show this is the case. In this situation the company will need to obtain a written evaluation of the company’s activities from an independent expert. This evaluation must support the company’s expectations that within 10 years its business will be based on the exploitation or use of the intellectual property it will be developing. The independent expert must be an expert in research and development or innovation and not connected with the issuing or relevant company in any way. They must also hold a relevant higher education qualification, which is a master’s degree or higher. The company must provide evidence that shows the individual is an expert in their field such as citations in academic papers.

The skilled employees condition:

A company will meet the skilled employees condition if at least 20% of the company’s full time equivalent employees are skilled employees.

To be classed as a skilled employee, an individual must:

- Be directly engaged in the research and development or innovation activities of the company.

- Hold a relevant higher education qualification of a master’s degree or above.

- Have a job role that requires them to hold a master’s qualification or above.

If the company is a parent of a group, the proportion of skilled employees is taken over the whole group.

Where a company is a knowledge-intensive company because it depends upon meeting the skilled employees condition, it must continue to meet that condition for at least 3 years following the date the investment was made.

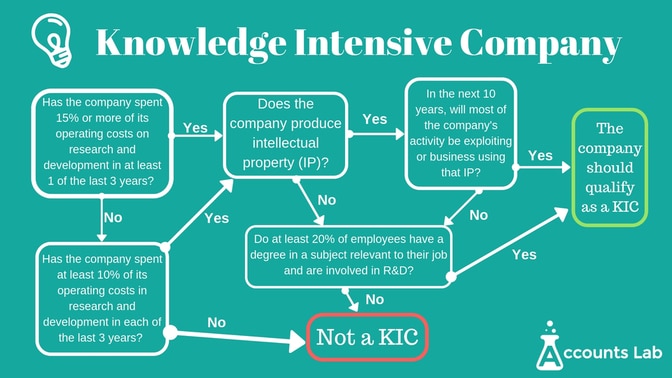

The following flowchart can help you establish whether or not your company could be classified as a knowledge intensive company.

Not sure if the EIS is at risk to capital condition? Click that link to our article to find out more!

The Enterprise Investment Scheme (EIS) is designed to help businesses grow by providing investors with tax relief, therefore reducing the risk around investing.

Sleek can help you to apply for advance assurance from the government to prove these tax benefits. We handle the entire process, reducing admin and stress, and providing expert advice.

For more information about the Enterprise Investment Scheme and knowledge intensive companies, please do not hesitate to contact us.