Decoding UTR numbers: what they mean for small businesses in the UK

In the UK tax system, Unique Taxpayer Reference (UTR) numbers play a crucial role in identifying and tracking individuals and businesses for taxation purposes. Whether you’re a sole trader, a self-employed individual, or a limited company, understanding how to apply for UTR number and manage it is essential for maintaining compliance and planning your tax obligations.

In this comprehensive guide, we’ll delve into the intricacies of UTR numbers, their significance, and how to navigate the processes associated with them.

What is a UTR Number?

A UTR number is a unique identification code assigned by HM Revenue and Customs (HMRC) to each taxpayer in the UK. Its purpose is to streamline tax-related processes and ensure accurate record-keeping.

UTR numbers are primarily used to identify taxpayers when communicating with HMRC and in various tax-related transactions. These numbers help individuals and the state to maintain compliance when it comes to taxes.

UTR numbers consist of 10 digits and letters. The structure of a UTR number comprises four sections, with each section serving a specific purpose. The first three digits represent the tax office that issued the UTR number, followed by a single letter indicating the tax year, and finally, six digits representing the unique taxpayer identification.

Obtaining a UTR number

The process of obtaining a UTR number differs for individuals and businesses as follows:

For individuals

When you register for Self Assessment with HMRC, you will automatically receive a UTR number. Self Assessment is applicable if you are self-employed, have income from rental properties, or earn income that is not taxed through PAYE (Pay As You Earn).

Wondering if there is a self assessment tax return guide? Don’t fret, we have got just the article for you.

For businesses

Businesses may require a UTR number for various purposes, such as filing tax returns for partnerships, self-employed individuals, and companies. To obtain a UTR number, businesses need to register with HMRC for the appropriate tax scheme. You can apply for UTR number online through the HMRC website or by calling the HMRC helpline. But, when you set up a limited company, you will automatically get a UTR number. Both you, as a director of the company, and the company, will be required to have a UTR number.

Curious about the tax return for self employed individuals? Here’s our guide, “A guide to understanding and filing self-employed tax returns in the UK“.

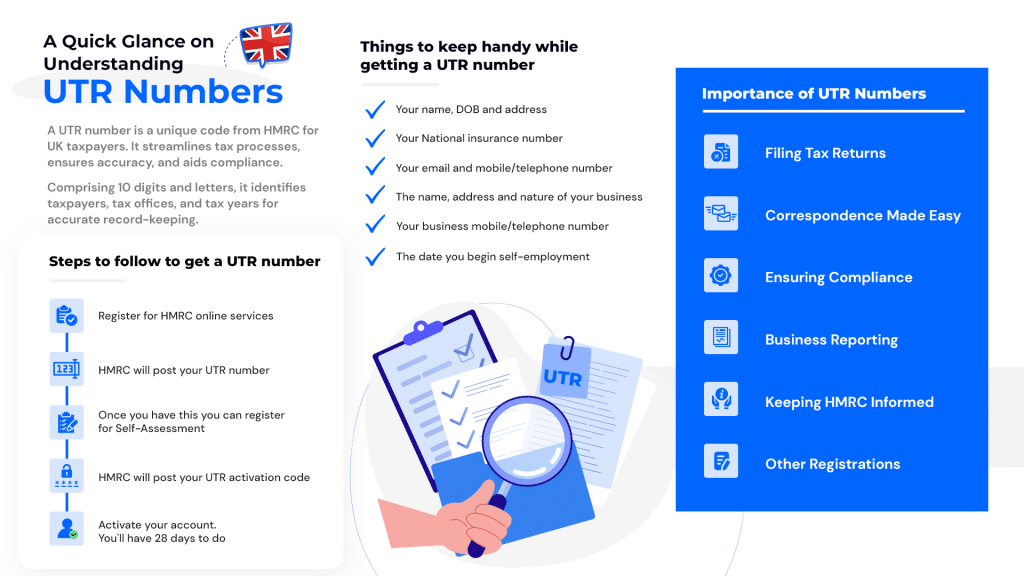

Steps to follow to get a UTR number

- Register for HMRC online services

- HMRC will post your UTR number

- Once you have this, you can register for Self Assessment

- HMRC will post your UTR activation code

- Activate your account. You’ll have 28 days to do so.

Things to keep handy while getting a UTR number

- Your name, DOB and address

- Your National Insurance number

- Your email and mobile/telephone number

- The name, address and nature of your business

- Your business mobile/telephone number

- The date you began self-employment

There will be some security checks, after which you will be eligible to get your UTR number. Don’t wait till the last minute to get your UTR number. Register for it as soon as possible!

Importance of UTR numbers for individuals

UTR numbers are integral to individuals’ tax-related activities. As an individual, there are several reasons for you to get your UTR number as soon as possible.

Filing Self Assessment tax returns

UTR numbers are linked to individuals’ personal tax accounts. When filing a Self Assessment tax return, the UTR number acts as a unique identifier, ensuring that HMRC can accurately associate the tax return with your account.

Correspondence with HMRC

When communicating with HMRC regarding tax-related matters, providing your UTR number is essential. It helps HMRC quickly identify and access your tax records, expediting the resolution of any queries or issues.

Tax compliance

UTR numbers facilitate compliance with tax obligations by enabling HMRC to track your income, expenses, and tax payments. By associating these financial details with your UTR number, HMRC ensures accurate assessment and reduces the likelihood of errors or discrepancies.

Importance of UTR numbers for businesses

Businesses, whether operating as partnerships, self-employed individuals, or limited companies, rely on UTR numbers for effective tax management. Here’s why UTR numbers are vital for businesses:

Filing tax returns

Businesses need UTR numbers when filing their tax returns. Each partner in a partnership, self-employed individual, and company director should have a UTR number to ensure accurate reporting and assessment.

Other registrations

Registrations for Value Added Tax, Company Tax, or Construction Industry Scheme (CIS) all require a UTR number .

Keeping HMRC in the loop

With a UTR number, you can contact HMRC for company-related issues, inform them about changes to your registered details or company structure and let them know if your business is dormant.

Correspondence with HMRC

Similarly to individuals, businesses use UTR numbers when communicating with HMRC. Whether it’s addressing queries, updating information, or resolving tax-related issues, providing the UTR number facilitates efficient correspondence and helps HMRC locate the relevant tax records.

Tax compliance

UTR numbers play a crucial role in ensuring tax compliance for businesses. By associating financial records with UTR numbers, HMRC can monitor businesses’ income, expenses, and tax payments, thereby reducing the risk of errors, penalties, or investigations.

Responsibilities and compliance

Understanding your responsibilities as a UTR holder is vital to maintaining compliance with HMRC’s regulations. Here are some key considerations:

Keeping UTR numbers secure

It’s essential to treat your UTR number as confidential information and keep it secure. Avoid sharing it with unauthorized individuals or entities to minimize the risk of identity theft, fraud, or misuse.

Complying with tax obligations

As a UTR holder, you must fulfill your tax obligations diligently. This includes filing tax returns accurately and on time, paying the correct amount of tax, and keeping records that support your tax calculations. If you’re unsure about any aspect of your taxes or need assistance with financial tax planning, consulting tax advisors at Sleek will save you time, money, and potential headaches. At Sleek, we provide accounting services to aid you with an efficient and seamless tax process

Notifying HMRC about changes

Inform HMRC promptly about any changes in your personal or business circumstances that may affect your tax affairs. This can include changes in address, business structure, or income sources. By updating your details, you help ensure that HMRC has accurate information for effective tax administration.

Managing UTR numbers

Effective management of UTR numbers involves two things:

Updating or changing UTR details

If there are changes to your personal or business details, such as a change in address or contact information, it’s important to inform HMRC. This can be done through the HMRC website or by contacting the HMRC helpline.

Retrieving a lost or forgotten UTR number

If you’ve misplaced or forgotten your UTR number, you can retrieve it by contacting HMRC. They will ask you some security questions to verify your identity before providing you with the necessary information.

Free yourself from the burden of Self Assessment. Let us help you stay on top of your tax return.

FAQs

No, a UTR number and a tax code are different. A UTR number is a unique identification code assigned to individual taxpayers or businesses by HMRC for tax-related purposes. On the other hand, a tax code is a numerical or alphanumeric code that HMRC uses to determine how much income tax should be deducted from an individual’s earnings by their employer.

Yes, as a sole trader, you will need a UTR number. When registering as self-employed with HMRC, you will automatically receive a UTR number. This UTR number is essential for fulfilling your tax obligations, including filing Self Assessment tax returns and communicating with HMRC regarding your business income and expenses.

If you have misplaced or forgotten your UTR number, you can retrieve it by contacting HMRC. You will need to provide some personal information and answer security questions to verify your identity. Once your identity is confirmed, HMRC will provide you with the necessary information to retrieve your UTR number.