Payroll dilemmas: Should you Navigating Payrolls with Confidence: A P32 Guide for Small Business Owners

Introduction to P32 & HMRC

Understanding the P32 form and how it helps is important for business owners to manage their payroll obligations is important.

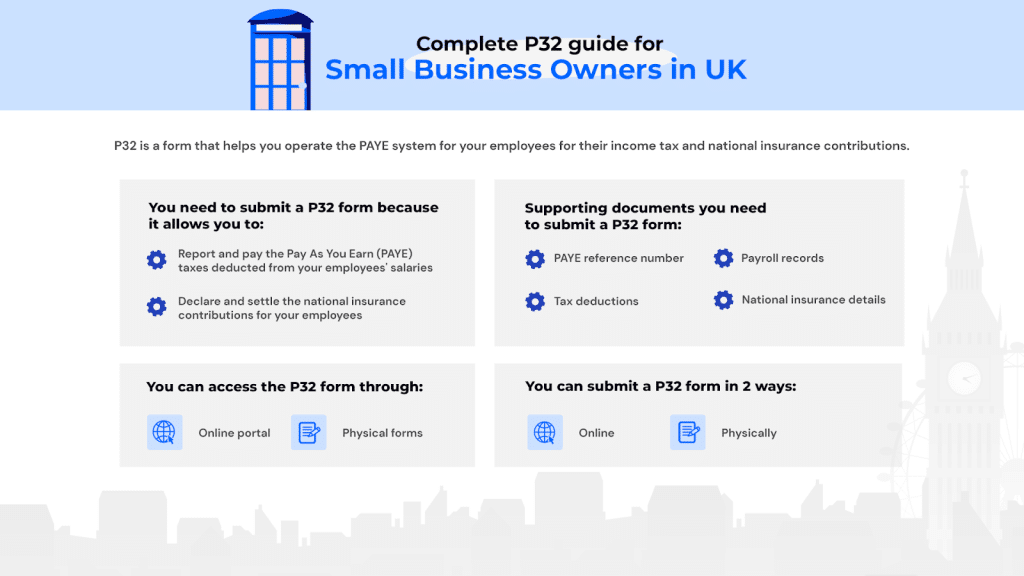

In short, P32 is a form that will help you operate a ‘Pay As You Earn’ (PAYE) system for your employees for their income tax and national insurance contributions. Think of it as the paperwork that keeps everything legit and above board. The government wants to ensure that you’re fulfilling your tax obligations and properly deducting the right amount of taxes from your employee’s wages.

We’re here to guide you through the ins and outs of the P32 form and demystify the process. So, let’s begin!

Why do you have to submit a P32 form?

The answer to this question lies in the world of taxes and compliance. Take a look at these key reasons why submitting a P32 form is a crucial part of your payroll obligations:

- PAYE Taxes: The P32 form allows you to report and pay the Pay As You Earn (PAYE) taxes deducted from your employees’ salaries. It ensures compliance with HM Revenue and Customs (HMRC) regulations and helps maintain accurate records of your tax liabilities. If you’re unsure as to how does PAYE works? Click that link to our article to find out more.

- National Insurance Contributions (NICs): Alongside PAYE taxes, the P32 form enables you to declare and settle the national insurance contributions for your employees. These contributions fund the country’s social security system, providing various benefits and pensions. Want to calculate your national insurance? We have just the article for you just click the link to find out more.

But it’s not just about fulfilling your tax obligations; it’s also about maintaining accurate records. The P32 form allows you to keep track of the taxes you’ve paid and the amounts owed to HMRC. It helps you stay organised and ensures that you have a clear picture of your company’s tax liabilities.

Additionally, submitting the form demonstrates your commitment to compliance and transparency. It shows that you’re operating within the guidelines set by HMRC and contributing your fair share to the national tax system.

So, while dealing with taxes might not be the most exciting part of running a firm, submitting the P32 form is a necessary step to keep everything in order, maintain compliance with HMRC regulations, and ensure the financial stability of your business.

Do small businesses need to submit the P32 form?

The answer is yes! Whether you’re a one-person operation or have a small team working for you, if you’re paying your employees through the PAYE system, you’re required to submit the P32 form.

Remember, staying compliant with tax requirements is essential for the smooth operation of your business. It helps you avoid penalties, maintain accurate financial records, and build trust with HMRC. So, embrace the P32 form and tackle your payroll obligations like a consummate professional.

How to access a P32 form

Accessing the P32 form is a straightforward process. Here are your options:

- Online portal: The most convenient method is through HMRC’s online services. By registering for an online account, you can access and complete the P32 form digitally. If you haven’t already, you’ll need to create an account on the HMRC website. Once you’re logged in, navigate to the Payroll section, and find P32 form. You can view it, download it, and even fill it out digitally. It’s like having a virtual secretary right at your fingertips.

Taking the online approach ensures efficient filing and gives you access to other relevant resources and updates.

- Physical forms: If you prefer a more traditional approach, you can request a physical copy of the P32 form from HMRC. However, it is worth noting that online submission is encouraged for faster processing and reduced chances of errors.

Whether you choose the digital route or opt for the tactile experience of paper, accessing the P32 form is a breeze. So, pick the method that suits your preferences, and let the form-filling adventure begin!

What supporting information do you require for a P32 submission?

When it comes to filling out the P32 form, you’ll need a few key pieces of information to ensure accurate reporting and proper tax calculations. Gather the following information and records:

- PAYE reference number: Your business’s unique PAYE reference number is crucial for correctly identifying tax liabilities and associating them with your company.

- Payroll records: Maintain comprehensive payroll records that include employee details, salary information, and the amounts deducted for PAYE taxes and NICs.

- Tax deductions: Ensure you have accurately calculated and accounted for the correct tax deductions for each employee. Double-check your calculations to minimise errors. Wondering how the UK super deduction tax incentive can help your business? If so, click that link to find out more.

- National insurance details: Keep track of the NICs made by your employees and ensure they align with the current rates and thresholds set by HMRC.

Remember, accuracy is key when it comes to filling out the P32 form. Having the supporting information readily available and double-checking the figures will save you time and potential headaches in the long run. So, gather your employee data, payment details, and other necessary information, and get ready to tackle that P32 form like a pro.

Let Sleek’s expert accountants handle your P32 submissions for you

How do you submit a P32 form?

So, you’ve filled out your P32 form and now it’s time to submit it. But how exactly do you do that? HMRC recommends an online submission. Simply log into your HMRC online services account, navigate to the Payroll section, and follow the instructions for submitting the form electronically. It’s quick, efficient, and saves you from the hassle of paper forms.

Make sure to submit your P32 form within the specified deadlines to avoid any penalties or issues. And don’t forget to double-check all the information before hitting that submit button or sealing that envelope.

Manage your business requirements like a pro

Navigating the world of P32 forms may seem like a daunting task for small business owners in the UK. However, with the right resources and support, you can tackle your payroll obligations with confidence and ease. And that’s where Sleek comes in.

Sleek is a trusted provider of corporate services, offering a range of solutions to simplify company compliance and administrative tasks. From company formation to ongoing support, we have your back. And when it comes to P32 forms, Sleek can be your ally in streamlining the process.

If you’re unsure about any aspect of your taxes or need assistance with financial tax planning, consulting our tax advisors for corporate tax advice will save you time, money, and potential headaches. To provide you with an efficient and seamless tax process, Sleek has the right set of solutions for you!

So, if you’re looking for a seamless and efficient way to handle your P32 form and other corporate needs, Sleek is the partner you can rely on. Explore our comprehensive services and discover how we can simplify your business operations.

FAQs

The deadline for submitting a P32 form falls on the 19th of each month following the end of the tax month.

Yes, there are penalties for late or incorrect P32 submissions.

Yes, it is possible to amend a submitted P32 form if you discover errors or omissions after submission.

Yes, it is highly recommended to keep a copy of the submitted P32 form for your records.

Yes, if you have multiple PAYE schemes, you will need to submit separate P32 forms for each scheme.