How much does an accountant cost in 2024?

Whether you’re just starting out or growing an existing business, every penny counts. From managing day-to-day operations to planning for the future, it’s easy to let things like bookkeeping and taxes fall by the wayside. But here’s the thing: a good accountant can be a game-changer. They can save you time, money, and a whole lot of headaches.

So, how much does an accountant cost? Well, it depends.

The cost of an accountant can vary based on factors like the size of your business, the complexity of your finances, and the services you need. Being aware of the costs involved in hiring an accountant and understanding alternatives can help you make informed decisions for your business. But don’t worry, we’ll break it all down for you.

In this post, we’ll dive into the typical fees for small business accounting services, what impacts pricing, and how to find the right accountant for your needs and budget.

Accounting costs for small businesses

Naturally, you’ve arrived here today because you want to answer the question of how much does an accountant cost? As a small business owner or sole trader, you wear many hats. From managing day-to-day operations to making strategic decisions, there’s a lot on your plate. And one of the most important aspects of running a successful business is keeping your finances in order. That’s where good accounting comes in. But for many, the thought of managing your own books can be daunting. After all, accounting is a complex and time-consuming task that requires a certain level of expertise and a lot or organisation.

Effective management of accounting costs in small businesses requires timely, prompt, and clear communication. With so many accounting firms offering different packages and fees, understanding your small business accounting needs is the first step in determining the right accountant for your business.

The importance of good accounting

Before we dive into the cost of hiring an accountant, let’s take a step back and understand why proper accounting is so important for your business. At its core, accounting is about tracking your financial transactions and using that information to make informed business decisions. Without accurate financial records:

- You won’t have a clear picture of your business’s financial health.

- You won’t know how much money you’re making.

- You won’t know how much you’re spending, or where you can cut costs.

This lack of visibility can lead to cash flow problems, missed opportunities, and even legal issues.

On the other hand, with professional accounting, you can:

- Make data-driven decisions about your business’s future.

- Identify areas where you can improve profitability.

- Ensure compliance with tax laws and regulations.

- Secure funding from investors or lenders.

- Plan for long-term growth and sustainability.

- Get quick, clear, and tailored answers to questions from a local expert. For instance, if you’re trying to figure out if it’s best to hire employees or contractors, or see if it’s possible for a sole trader to have employees; information online might not be relevant to your unique set-up. A good accountant offers tailored guidance rather than generic consensus.

In short, accounting is the foundation upon which your business is built. And investing in proper accounting practices can pay off in spades down the line.

The cost of hiring an accountant in the UK

So, how much does it cost to hire an accountant for your small business?

The answer, of course, is “it depends.” Accounting fees can vary widely based on a number of factors, including:

- The size and complexity of your business.

- The scope of services you require (bookkeeping, tax preparation, financial planning, etc.).

- The experience and qualifications of the accountant.

- Your location and market rates.

That said, here are some general ranges you can expect to pay for accounting services:

|

Service |

Cost Range |

|---|---|

|

Bookkeeping |

£20-£50 per hour |

|

Tax preparation |

£150-£500 per return |

|

Financial planning |

£100-£300 per hour |

|

Part-time CFO services |

£1,000-£5,000 per month |

Keep in mind that these are just rough estimates, and your actual costs may be higher or lower depending on your specific needs and circumstances. Some accountants may also offer package deals or retainer-based pricing, which can provide more predictability and cost savings over time.

How much does an accountant cost at Sleek?

Sleek provides affordable, pay-monthly accounting for limited companies, sole traders, contractors, and start-ups.

- Annual accounts start from £49.99 per month.

- Self assessment tax returns start from £250 a year.

- Tech start-up accounting starts from £150 per month.

We also offer a range of related services, designed to make you life easier, and ensure your business gets the support it deserves.

Request an instant quote or book a call with our team today. We’ll give you an instant breakdown of the costs, and explain the perks of dealing with a UK-based firm for your accounting needs.

Factors to consider when hiring an accountant

Cost is certainly an important factor to consider when hiring an accountant, but it shouldn’t be the only one. Here are a few other things to keep in mind:

- Expertise: Look for an accountant who has experience working with businesses in your industry and can provide tailored advice and guidance.

- Communication: Choose an accountant who is responsive, proactive, and easy to work with. You should feel comfortable asking questions and raising concerns.

- Technology: Consider whether the accountant uses modern accounting software and tools that can streamline processes and provide real-time insights into your financial data.

- Scalability: As your business grows, your accounting needs may change. Look for an accountant who can adapt and scale their services to meet your evolving needs.

Ultimately, the right accountant for your small business will depend on a variety of factors unique to your situation. But by considering cost alongside expertise, communication, technology, and scalability, you can find an accounting partner who will help you build a strong financial foundation for your business.

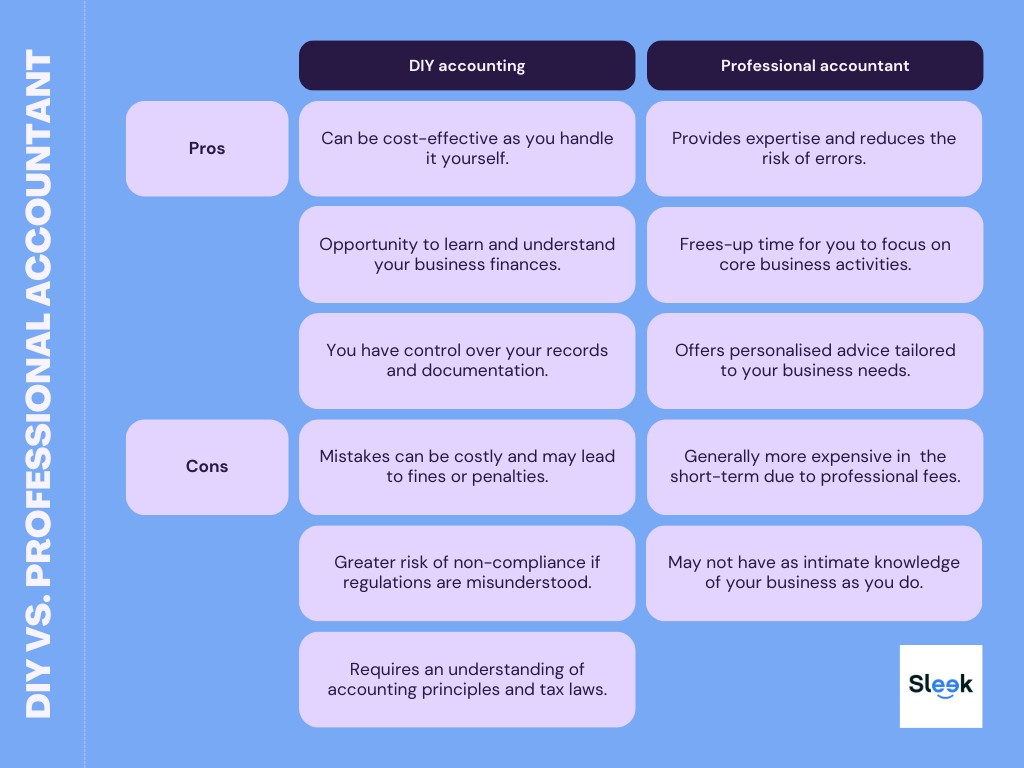

DIY accounting vs. hiring a professional

Of course, hiring an accountant isn’t the only option. Some choose to handle their own accounting in-house, using software like QuickBooks or Xero to manage their books.

The advantage of DIY accounting is that it can be more cost-effective, especially for very small businesses with simple financial needs. However, it also requires a significant time investment and a certain level of accounting knowledge to ensure accuracy and compliance.

As your business grows and your finances become more complex, it may make sense to outsource your accounting to a professional. An experienced accountant can provide valuable insights and advice, help you navigate tax laws and regulations, and free up your time to focus on other aspects of your business.

Ultimately, the decision to DIY or hire an accountant will depend on your business’s unique needs, resources, and goals. But whether you choose to handle your own books or work with a professional, the key is to prioritise accurate and timely financial management from day one.

The bottom line…

Accounting may not be the most glamorous part of running a business, but it’s certainly one of the most important. By investing in proper accounting practices – whether through DIY software or hiring a professional – you can build a strong financial foundation for your business and make informeddecisions that drive long-term success.

While the cost of accounting services may seem daunting at first, it’s important to remember that it’s an investment in your business’s future. With the right accounting partner by your side, you can navigate financial challenges, seize opportunities for growth, and achieve your most ambitious business goals.

FAQs in relation to how much does an accountant cost?

How much is an accountant fee in UK?

In the UK, small business accountants typically charge between £25 and £150 per hour. Factors like experience and service complexity affect rates.

How much should I pay for a good accountant?

Aim to spend around 2% to 5% of your annual turnover on accounting services to ensure quality without overspending. Sleek accountancy costs start from just £49.99 a month.

How much does an accountant cost for a sole trader?

Sole traders accountancy services cost from £250 annually for basic tax filing services.

How much is an accountant hourly UK?

An average hourly rate for accountants in the UK hovers around £35 to £100, depending on their expertise level. The cost of an accountant with Sleek is spread over affordable monthly payments that start from £49.99 a month.

Conclusion

So, how much does an accountant cost? As you can see, it varies. But by understanding the factors that impact pricing and the different fee structures available, you can find an accounting solution that fits your business like a glove.

Remember, a good accountant is an investment in your business’s financial health and future success. They can save you time, money, and stress in the long run. So don’t be afraid to shop around, ask questions, and find the right fit for you.

Ready to take control of your small business finances? Start exploring your accounting options today. Your future self (and your bottom line) will thank you.