Payroll dilemmas: Should you hire employees or contractors?

The UK is swiftly becoming a nation that’s leading the trend of self-employment. With more people preferring to work for themselves, the debate of employees vs contractors is quickly gaining steam in the country. Businesses are also now pivoting to more collaborative approaches to work.

According to data published by Statista, 4.44 million people in the UK were considered to be self-employed as of April 2023. As the hiring market gets tougher, scouting for independent talent in ways that are compliant with UK laws is also getting increasingly complicated for smaller companies.

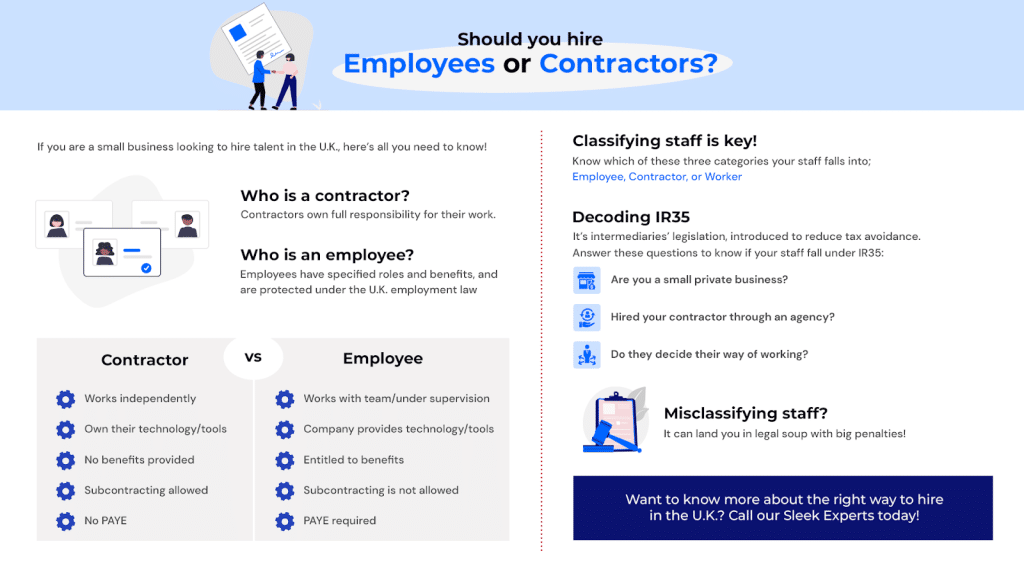

So, if you are a small business looking to hire talent in the UK, here are a few questions for you to ponder over. Employee vs contractor – which role is more suitable for your business? What’s the difference between an employee and a contractor in the UK? What are the penalties for an organisation that misclassifies labour?

Don’t worry, we have all the answers! Here’s some crucial information to know before you make another hiring decision.

Who classifies as a contractor?

In the UK, contractors own complete responsibility for their work, working hours, deadlines, and place of work. They are expected to meet deadlines without supervision and submit receipts for their finished work. Since they are deemed ‘independent’ in their association with an organisation, contractors are expected to take care of their taxes and insurance coverage by themselves.

Who classifies as an employee?

An employee usually has a well-defined role within an organisation. When a company hires employees, their employment status is specified and this grants them protection under the UK’s employment law. Under this law, employees are entitled to benefits such as maternity leave and sick leave, and cannot be fired unfairly or without due process.

Employee vs contractor: Know the differences

Contractor | Employee |

Works independently: A contractor is expected to work with little to no supervision. Contractors can choose to work from anywhere they like. | Aligned with the company: An employee work under the supervision of supervisors and is usually expected to work out of an office. |

Bring their own tools (BYOT): Contractors use their own tools and technologies for work. | Tools are company-sponsored: The technology or equipment used by employees is provided by the company. |

No benefits: Contractors are not entitled to benefits such as vacations and company insurance. | Entitled to benefits: Businesses are obligated to provide benefits such as statutory paid leaves, sick days and insurance coverage to their employees. |

Work at their own risk: Contractors are responsible for the risks associated with their work and payment. | Mitigated risks: Companies must ensure that employees are safe while at work and that salaries are paid on time. |

Hiring help: Contractors can hire or subcontract work to others to get it done on time. | No sub-contracting allowed: Employees cannot hire others to help with their work as they are bound by employment laws. |

No PAYE enrollment: As contractors pay their own taxes, there is no need to enrol in the pay as you earn (PAYE) system. | PAYE enrollment mandatory: Employees need to be enrolled in the PAYE scheme. This ensures taxes and national insurance contributions are collected from their salaries. |

Classifying staff for small businesses – compliance is key!

Under UK law, there are three broad classifications of labour: employee, contractor and worker. Employees are hired by companies in compliance with the employment laws of the UK, while contractors are hired for specific work and in a temporary manner.

The third categorisation of labour – the worker – has similar functionalities and enjoys certain benefits like employees, but also has additional rights such as being able to reject work offers from an employer. Workers can be on a company’s payroll while working intermittently or casually. While they enjoy certain benefits, they lack many privileges of employees, including a:

- Stipulated notice period in case of termination

- Flexible working arrangement

- Due process for dismissal from employment.

Understanding this categorisation is important for small firms to accurately classify their workforce and pay taxes to the government. Misclassifying staff can land you into some serious legal soup! Are taxes giving you nightmares? Don’t worry, Sleek is here to help you. Click here to connect with our friendly and knowledgeable experts today.

Understanding UK employment law: All you need to know

The classification of labour is a crucial part of the UK’s employment law. Once you’ve understood this categorisation, you need to grasp the nuances that differentiate these categories from one another. Even though there are very clear demarcations between the three categories of employment, their responsibilities may shift around at times depending on the nature of their associations with a hiring body. This is where companies should be careful in order to avoid getting into legal trouble.

For example, contractors are self-employed individuals who are responsible for their successes and failures. But their status could change to that of a worker if they have entered a signed agreement with an employer. Contractors could also be considered employees if they are hired by an agency to work for a client. In these cases, the court may rule that these individuals are entitled to receive certain benefits from the employers in question.

Are you a business owner? If so, you should be aware of the importance of the P23 form. Click on the link to learn more about it.

Get in Touch with Sleek’s Expert Accountants – Let Us Manage Your Payroll Hassle-Free!

Decoding IR35: It’s not that complicated!

The Inland Revenue 35 (IR35) legislation, also commonly known as ‘off-payroll working rules’ or intermediaries’ legislation, is a collection of tax laws introduced in 2000 to reduce tax avoidance by individuals as well as organisations. This law has restructured the definition of employment for both contractors and employees to ensure there is no disparity in the way taxes are calculated and paid by contractors and employees engaging in the same type of work.

IR35 legislation has been brought in to ensure that companies pay their taxes in the right manner, their employees have clearly defined employment statuses and benefits, and their contractors pay their taxes and national insurance contributions (NICs) from their earnings.

If you are a small business, here are a few questions to help determine whether you fall under or outside the purview of IR35:

- Can you be classified as a small business in the private sector?

- Have you hired your contractor through an agency?

- Does the contractor decide how and when they work?

Once you figure out the answers to these questions, you can confidently classify your staff. Continuous reforms are being introduced to IR35 so individuals and organisations must remain aware of them as well as comply with them.

Misclassifying staff: What are the penalties?

Misclassifying your staff can come with grave consequences, especially if you are a small business. If an individual is wrongly categorised as a contractor instead of an employee, they can lose out on several benefits such as maternity leave, paid leaves, retirement facilities, minimum wage, and more. This will be considered a major lapse on the part of the business. In addition to huge penalties, the reputation of the company could also take a hit.

In May, the Guardian reported that sporting goods giant Nike may be looking at a hefty penalty payment of more than $500m for misclassifying their staff across several countries including the UK. So it’s safe to say that if a firm misclassifies its people and the government discovers the discrepancies, it will end badly, usually in huge penalties that are probably a lot more than what the company may have ‘saved’.

Therefore, make sure to classify your employees the right way, especially if you are a small business in the UK.

The right way to hire and pay

The right way to hire a contractor in the UK would be to use an independent contract agreement with clearly specified expectations that is drafted in compliance with IR35 legislation.

An independent contractor agreement should contain details of the work and employment, such as:

- Start and end dates

- Pay structure, modes of payment, and schedule

- Responsibilities for completion of tasks

- Termination guidelines.

There are four major ways to pay an independent contractor:

- Direct bank transfer

- Money order

- Online money transfer portals

- Centralised payment platform for contractors.

Employees should be hired and compensated in compliance with UK employment law. They should also be provided with stipulated benefits such as leaves, insurance, and such.

Not sure whether to hire a contractor accountant? Fret not, we have an article that may help. Click the link to find out more.

If you’re looking to hire an accountant for your small business but not sure how to get started. Read our article “What to look for in your Small Business Accountant in the UK: Your Guide to Finding the Perfect Match“.

In a nutshell

If you are a small business in the UK, make sure you know the employment and tax laws of the land and abide by them to ensure you become and remain a success. Looking for expert advice on the various aspects of running a small company? Talk to the experienced experts at Sleek today.

Relieve yourself of admin, save time and streamline your business processes with fully managed payroll services under one roof. We handle your payroll so that you can grow your business.

FAQs

This depends on your requirements as employees and contractors play different roles and have different work rules. Whatever you do, make sure your hiring decisions are aligned with UK employment laws.

To determine whether your firm is bound by IR35 legislation, simply answer a few questions such as if you are a small business in the private sector, or if you have hired your contractor through an agency. This will help you understand your legal duties as an employer in the UK. To make it even simpler, talk to the experts at Sleek today and get answers to all your employment doubts.