What is Married Couple’s Allowance in the UK and can I claim it?

The United Kingdom has several tax benefits when it comes to couples residing in the country. Two main tax allowances are available to married or civil-partnered couples:

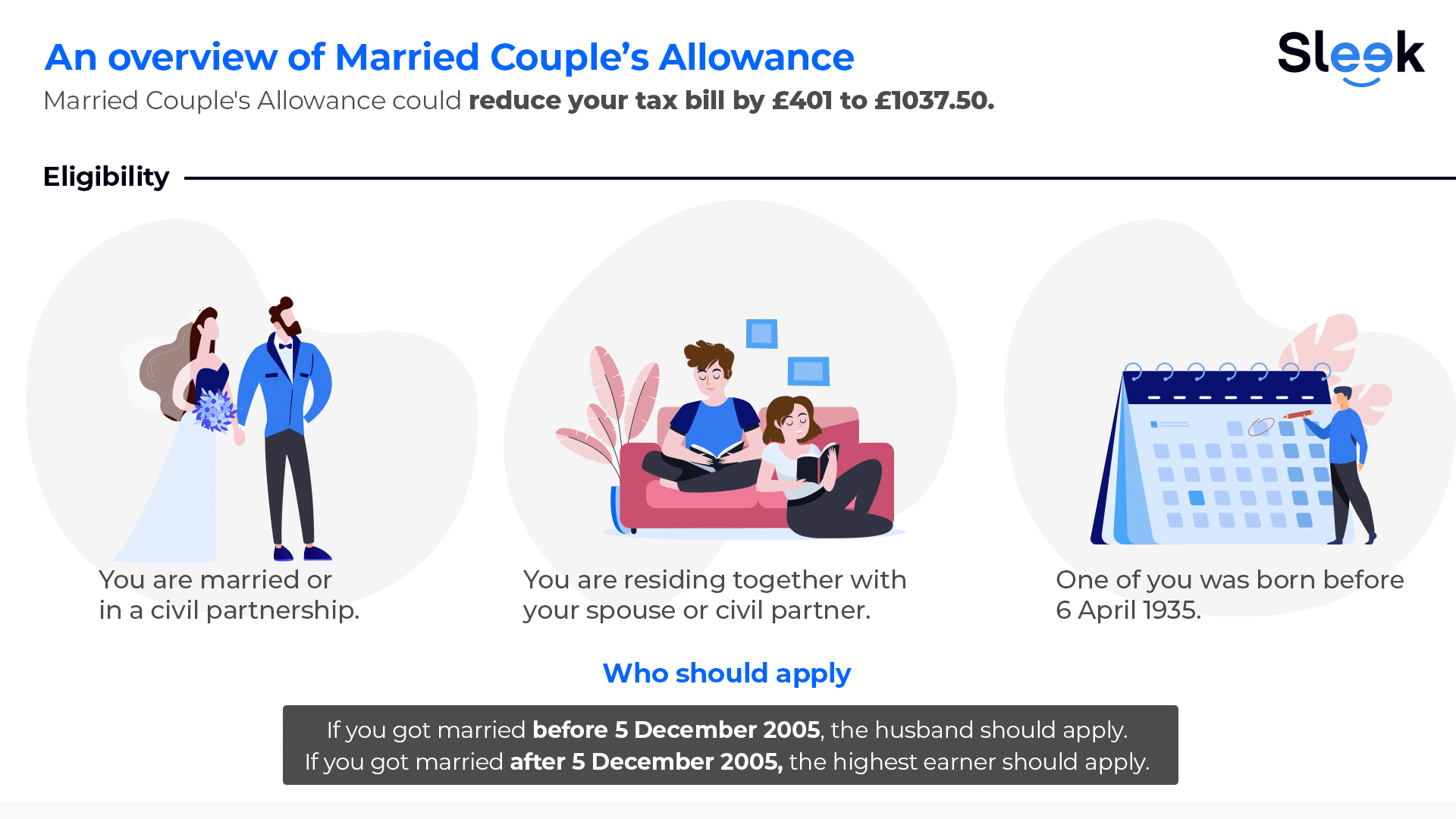

Although they sound similar, Marriage Allowance and Married Couple’s Allowance have significant differences in terms of eligibility and benefits. The latter is for couples with one spouse born before 6 April 1935 and, unlike Marriage Allowance, it doesn’t lower taxable income but cuts taxes owed. More on this later.

What is Married Couple’s Allowance?

Photo by Asso Myron on Unsplash

Married Couple’s Allowance is a tax break for married couples and civil partners in the UK. It is available if one of you was born before 6 April 1935.

Moreover, if you got married before 5 December 2005, the allowance depends on the husband’s income. But if your marriage took place after that date, it’s determined by whoever earns more.

You are eligible to receive Married Couple’s Allowance if the following conditions are met:

- You are married or in a civil partnership.

- You are residing together with your spouse or civil partner.

- One of you was born before 6 April 1935.

If you cannot live with your spouse or civil partner due to the following reasons, you can still apply for the Married Couple’s Tax Allowance:

- Health issues or old age, such as when your spouse or partner is in a care facility.

- Working away from your home.

- An assignment in the armed forces.

- Incarceration.

- Engaged in training or education.

How does Married Couple’s Tax Allowance work?

If you’re married or in a civil partnership, Married Couple’s Tax Allowance can lower your annual tax payment. In the 2023/2024 tax year, it has the potential to reduce your tax bill by an amount ranging from £401 to £1,037.50.

To get the best savings, you should calculate how much tax you will be paying with and without Married Couple’s Allowance. This will allow you to make an informed decision on which option will lead to more tax savings.

How do I calculate how much I could get from Married Couple’s Allowance?

Calculating Married Couple’s Tax Allowance is an arduous process. However, for a basic idea of what you could get, you can refer to the UK government’s Married Couple’s Allowance calculator.

For that, you’ll be required to provide some information related to:

- Whether you’re married or are in a civil partnership

- If you’ve married before 5 December 2005

- Husband’s date of birth (if you got married before 5 December 2005)

- Highest earner’s date of birth (if you got married after 5 December 2005)

- Husband’s or higher earner’s yearly income

- If you’re paying into a pension

- How much you’re expected to pay into a retirement annuity contract (if you pay into a pension)

- Pension provider’s tax relief

- Expected donation or charity for the year

Save yourself the hassle of applying for Married Couple’s Allowance. Get in touch with Sleek’s tax accounting experts and we will sort it out for you.

How do I work out my Income Tax if I’m earning income other than my wages?

When you have income apart from wages (i.e. tips, commissions, rent, royalties, dividends, etc.) and need to calculate the appropriate payment, you have a couple of options:

- Reach out to the Income Tax helpline for guidance and clarification.

- Consider having a conversation with an accountant; accounting service providers like Sleek can assist you in working out the calculations and arriving at the right tax amount.

Can I claim Married Couple’s Tax Allowance if I’m unemployed?

Certainly, if one person in the couple is unemployed and the other partner earns above their Personal Allowance, the unemployed individual can apply for Married Couple’s Allowance.

However, in the case of couples who got married before 5 December 2005, the Married Couple’s Allowance is computed based on the husband’s income. For couples who married or entered into civil partnerships after this date, the allowance is determined by the income of the partner who earns more.

Can I claim Married Couple’s Allowance if my civil partner or spouse has died?

No, you cannot claim Married Couple’s Allowance if your civil partner or spouse has died. This is because the allowance is only available to couples who are living together.

You will continue to receive the allowance for the present tax year (until 5 April). However, HMRC will cease it automatically afterwards, and you will receive only your standard Allowance.

Should I or my partner apply for Married Couple’s Allowance?

If you got married or formed a civil partnership prior to 5 December 2005, the calculation of the Married Couple’s Allowance is based on the husband’s income. Following this date, it is determined by the income of the partner with the highest earnings.

So if you got married before 5 December 2005, the husband should apply.

But if you got married after this date, the best way to decide who should claim Married Couple’s Allowance is to work out who will benefit the most financially. This will depend on your individual income and tax rates.

In a nutshell, if you got married after 5 December 2005, the highest earner should apply.

Stop worrying about accounting and focus on what matters

How to apply for Married Couple’s Allowance

If you file a Self Assessment tax return each year: You can claim Married Couple’s Allowance by completing the relevant section of your tax return. This section will ask for your spouse or civil partner’s date of birth and their National Insurance Number. Once you have completed this section, you will need to send your tax return to HMRC.

If you do not file a Self Assessment tax return each year: You can still claim Married Couple’s Allowance by contacting HMRC. You will need to provide HMRC with details of your marriage or civil partnership ceremony, and your spouse or civil partner’s date of birth. HMRC will then process your claim and send you a letter confirming your entitlement to Married Couple’s Allowance.

Not sure how to register for self assessment or how to go about paying your self assessment tax? We have created articles answering those questions.

Will my tax code change if I claim Married Couple’s Allowance?

No. Unlike Marriage Allowance, Married Couple’s Allowance works by reducing your final tax bill, rather than changing your tax code.

Example of a couple applying for Married Couple’s Allowance

Let’s say John and Mary got married before 5 December 2005 and John was born before 6 April 1935.

- John earns £40,000 per year and Mary earns £50,000, including their income earnings, pensions and any taxable benefits, eg. Carer’s Allowance.

- However, because John and Mary got married before 5 December 2005, their Married Couple’s Allowance claim will be based on John’s income of £40,000.

- John and Mary use the government calculator and include information about John’s earnings, his pension contributions and his Gift Aid contributions.

- They find out that John qualifies for Married Couple’s Allowance and will get £767.50 off his tax bill.

- If John and Mary had gotten married after 5 December 2005, Mary would qualify for Married Couple’s Allowance and would be entitled to £401 off her tax bill.

Conclusion

Married Couple’s Allowance is a great tax relief scheme and can save you up to £1,037.50.

However, calculating Married Couple’s Allowance is not easy; you will need to provide information on all your taxable income including earnings, pensions and any taxable benefits, as well as how much you are paying towards a state pension and your Gift Aid contributions. Making the decision of which one of the spouses or civil partners will be claiming the allowance can be tricky too.

Here at Sleek, we provide accounting services for the entrepreneur who has more important things to worry about. We have tax accounting experts onboard that can take care of your entire personal tax needs, including Married Couple’s Allowance. Feel free to get in touch with us now.

FAQs

The amount of tax you can save with Married Couple’s Allowance depends on the income of the higher-earning partner (or the husband if you were married before 5th December 2005). If the higher-earning partner earns between £12,571 and £50,270, you can save up to £1,037.50 per year.

- Married Couple’s Allowance is only available to couples where one of them was born before 6 April 1935. Marriage Allowance is available to all married couples and civil partners, regardless of when they were born.

- The maximum amount of tax relief you can claim with Married Couple’s Allowance is £1,037.50, whereas with Marriage Allowance it is £252.

No, you cannot claim Married Couple’s Allowance if you are separated or divorced. You must be living together as a married couple or civil partners to be eligible for Married Couple’s Allowance.