What is Marriage Allowance in the UK and can I claim it?

Did you know you can save up to £252 in taxes through Marriage Allowance if you and your spouse reside in the UK?

What is Marriage Allowance?

Marriage Allowance is a UK tax relief scheme that allows one married or civil partnered individual to transfer £1,260 of their Personal Allowance to their spouse or civil partner.

This means that the higher-earning partner can earn an extra £1,260 before they start paying Income Tax. This reduces their tax by up to £252 in the tax year.

To be eligible for Marriage Allowance, you must:

- Be married or in a civil partnership

- Both be living in the UK

- One partner must have an income of less than £12,570 (2023/24 tax year)

- The other partner’s income must be between £12,571 and £50,270 (£43,662 in Scotland)

Want to know the difference between Marriage Allowance and Married Couples Allowance? Check out our article, “What is Maried Couple’s Allowance in the UK and can I claim it?“.

Looking for an accountant to manage your tax return? Our experts are here to help you.

How does Marriage Allowance work?

Here’s how Marriage Allowance works in more detail:

- The lower-earning partner applies for Marriage Allowance online or by post.

- HMRC (Her Majesty’s Revenue and Customs) will then transfer £1,260 of the lower-earning partner’s Personal Allowance to the higher-earning partner.

- The higher-earning partner’s tax code will be updated to reflect the additional Personal Allowance.

- The higher-earning partner will then see their Personal Allowance increased, which means that they will see their Income Tax reduced by up to £525.

Here the catch is to calculate how much tax the couple will be paying with and without Marriage Allowance. This will allow the couple to make an informed decision on which option will lead to more tax savings.

For example, in specific circumstances, the suitability of Marriage Allowance depends on the income of the lower earner and the income of the higher earner.

If the lower earner’s income is relatively high or the higher earner’s income is quite low, you might not receive the advantages of Marriage Allowance.

To determine potential savings if you decide to apply, you can use this calculator.

How do I calculate how much I could get from Marriage Allowance?

Marriage Allowance can save you up to £252 per year in Income Tax. It is a simple way to save money on your Income Tax if you are married or in a civil partnership.

You can calculate how much Marriage Allowance you could get using this calculator.

You’ll need to provide the following information to make your calculation:

- The country you live in

- Your income (before tax)

- Your partner’s income (before tax)

How much Income Tax will I pay if I’m earning income other than my wages?

The amount of Income Tax you pay if you earn income other than wages depends on several factors, including:

- The type of income you earn

- Your total income

- Any tax reliefs or allowances you are eligible for

The first step is to calculate your total income. This includes all of your income from all sources, including wages, self-employment income, rental income, interest income, and dividends.

Need help calculating your income or looking for a self employed tax calculator? Check out our article, “Self-employed in the UK? Calculate your income with a tax calculator“.

Once you have calculated your total income, you must subtract your Personal Allowance. Personal Allowance is the income you can earn before you start paying Income Tax. In the 2023/24 tax year, Personal Allowance is £12,570.

After subtracting your Personal Allowance, you must consider any tax reliefs or allowances you are eligible for. There are several different tax reliefs and allowances available, so you should check with HMRC to see if you are eligible for any.

Stop worrying about accounting and focus on what matters.

Can I claim Marriage Allowance for previous years?

Yes, you have the option to retroactively apply your entitlement to Marriage Allowance for any tax year starting from 5 April 2019, provided you were eligible for it during those years.

The amount by which your partner’s tax liability decreases will depend on the applicable Personal Allowance rate for the respective backdated years.

Can I claim Marriage Allowance if I’m unemployed?

Yes, if you or your spouse/partner is unemployed and the other partner earns more than the Personal Allowance, the unemployed person can claim Marriage Allowance.

Can I claim Marriage Allowance if my civil partner or spouse has died?

There are two scenarios in case your partner dies. Either you’ve transferred your Marriage Allowance to them or vice versa. This is what will happen in each scenario:

- If your partner dies after you’ve transferred some of your Personal Allowance to them: The transfer will be reversed and you will be able to claim your Personal Allowance back. This will happen automatically, so you do not need to do anything.

- If your partner transferred some of their Personal Allowance to you before they died: You will be able to continue claiming the transferred amount until the end of the tax year in which they died. After that, you will no longer be able to claim the transferred amount.

You can learn more about this on the GOV.UK website.

Should I or my partner apply for Marriage Allowance?

If neither of you has any income apart from your wages, the individual with the lower earnings should submit the claim.

However, if either of you receives additional income, like dividends or savings, you may need to determine who should make the claim by calculating your Income Tax (see above).

How to apply for Marriage Allowance

Here are some ways to apply for Marriage Allowance in the UK:

Apply online

- Go to the HMRC website and click on “Apply for Marriage Allowance”.

- You will need to create an account or log into your existing HMRC account.

- You will need to provide your personal details, including your National Insurance number and your partner’s National Insurance number.

- You will need to confirm that you are both married or in a civil partnership and that you both meet the eligibility criteria.

- You will need to provide your bank account details.

- You can apply for Marriage Allowance at any time, but you can only claim it for tax years that have already started.

What documents you will need

- You will need your National Insurance number and your partner’s National Insurance number.

- You will need a copy of your marriage certificate or civil partnership certificate.

- If you are self-employed, you may also need to provide a copy of your Self Assessment tax return.

Other ways to apply

- You can apply for Marriage Allowance through Self Assessment if you are self-employed..You can also apply by post by filling in Form MATCF and sending it to the address on the form.

Not sure how to How to pay Self Assessment tax in the UK? We have got just the article for you.

Save yourself the headache of applying for Marriage Allowance. Get in touch with Sleek’s tax accounting experts.

Will my tax code change if I claim Marriage Allowance?

Certainly, both you and your partner will receive updated tax codes concluding with:

- ‘M’ if you are receiving the allowance

- ‘N’ if you are transferring the allowance

Can I cancel my Marriage Allowance claim?

In a nutshell: yes, you can.

When you should cancel

You should cancel your Marriage Allowance if any of the following changes:

- Your relationship ends – because you’ve divorced, you have ended (‘dissolved’) your civil partnership or you are legally separated.

- Your income changes and you’re no longer eligible.

- You no longer want to claim.

How to cancel

If your relationship has ended, either partner can initiate the cancellation process.

If you’re cancelling for a different reason, the individual who initially made the claim should handle the cancellation.

There are two approaches to this:

- Online: You have the option to cancel Marriage Allowance online. During the process, you’ll need to verify your identity using the information that HMRC has on record for you.

- By phone: To cancel or receive assistance with Marriage Allowance, please get in touch with Marriage Allowance enquiries.

What happens after you cancel?

Once you have cancelled your Marriage Allowance claim, the transfer of your Personal Allowance will stop and you or your partner will no longer be able to claim the tax relief.

The cancellation will take effect from the start of the next tax year. For example, if you cancel your Marriage Allowance claim in March 2023, the cancellation will take effect from 6 April 2023.

Your partner’s tax code will be updated to reflect the cancellation of the claim.

Find more about how to cancel and what happens after you cancel on the GOV.UK website.

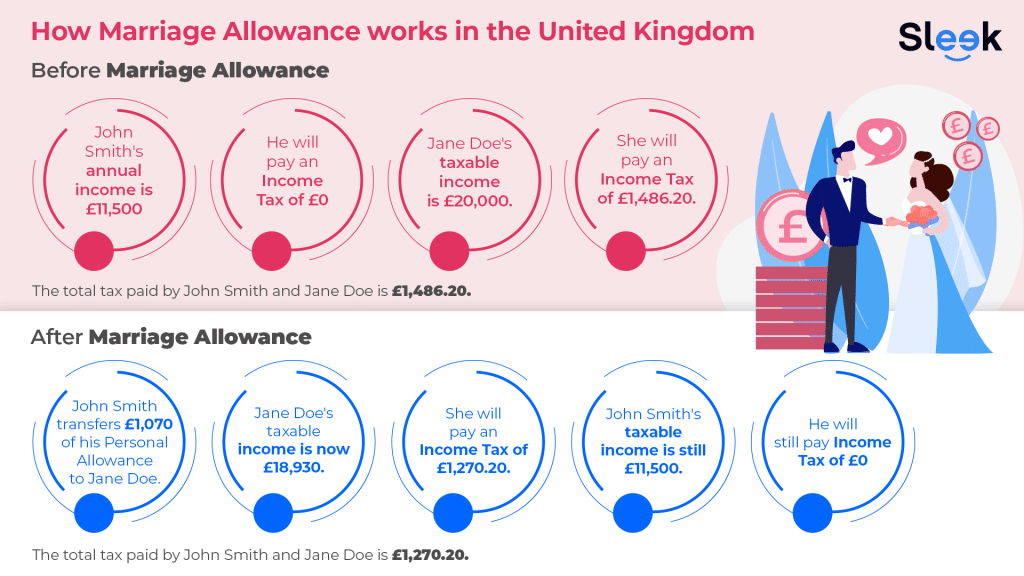

Example of a couple applying for Marriage Allowance

Here is an example of how Marriage Tax Allowance would work for a couple having the following income summary:

Partner 1:

- Name: John Smith

- Income: £11,500

- Income Tax: £0

Partner 2:

- Name: Jane Doe

- Income: £20,000

- Income Tax: £1,484.20

In this example, John Smith is the lower earner and Jane Doe is the higher earner. John Smith can transfer £1,070 of his Personal Allowance to Jane Doe, which will reduce her taxable income by £1,070 and save her £214 in tax.

Conclusion

Marriage Allowance is a great way to save taxes in the UK. By utilising this government initiative, couples can reduce their tax burdens and allocate those saved funds toward other essential expenses or investments.

For those seeking expert assistance in navigating the intricacies of the tax system and making the most of the Marriage Allowance, Sleek could be the partner for you. Sleek can provide you and your company with efficient and transparent accounting and tax services. Get in touch with our tax accounting experts if you wish to find ways to lower your taxes, such as Marriage Allowance.

FAQs

The Marriage Tax Allowance process in the UK can be a bit complicated, especially if you are not familiar with the UK tax system.

The documentation or information required to apply for Marriage Allowance in the UK includes:

- Your National Insurance number

- Your partner’s National Insurance number

- Your most recent tax returns

- A marriage certificate or civil partnership certificate

- If you are applying online, you will also need to create a Government Gateway account.